Exponential Smoothing with Trend

Holt’s Linear Trend Method

Also known as Double Exponential Smoothing, This method extends the simple smoothing method with a trend component. We will use $x$ and $l$ interchangeably. \begin{align} x_{t+h|t} &= l_{t} + hb_{t}\newline l_{t} &= \alpha x_{t} + (1-\alpha)x_{t|t-1}\newline &= \alpha x_{t} + (1-\alpha)(l_{t-1} + b_{t-1})\newline b_{t} &= \beta(l_{t} - l_{t-1}) + (1-\beta)b_{t-1}\end{align}

where $l$ is the level and $b$ is the trend. The level equation is same as simple exponential smoothing, weighted sum of the series value at last time step and the forecasted value at the last time step ($l_{t-1} + 1 \times b_{t-1}$). The new component of trend is a weighted sum of trend estimate at last time step and the trend adjusted by taking the difference in levels.

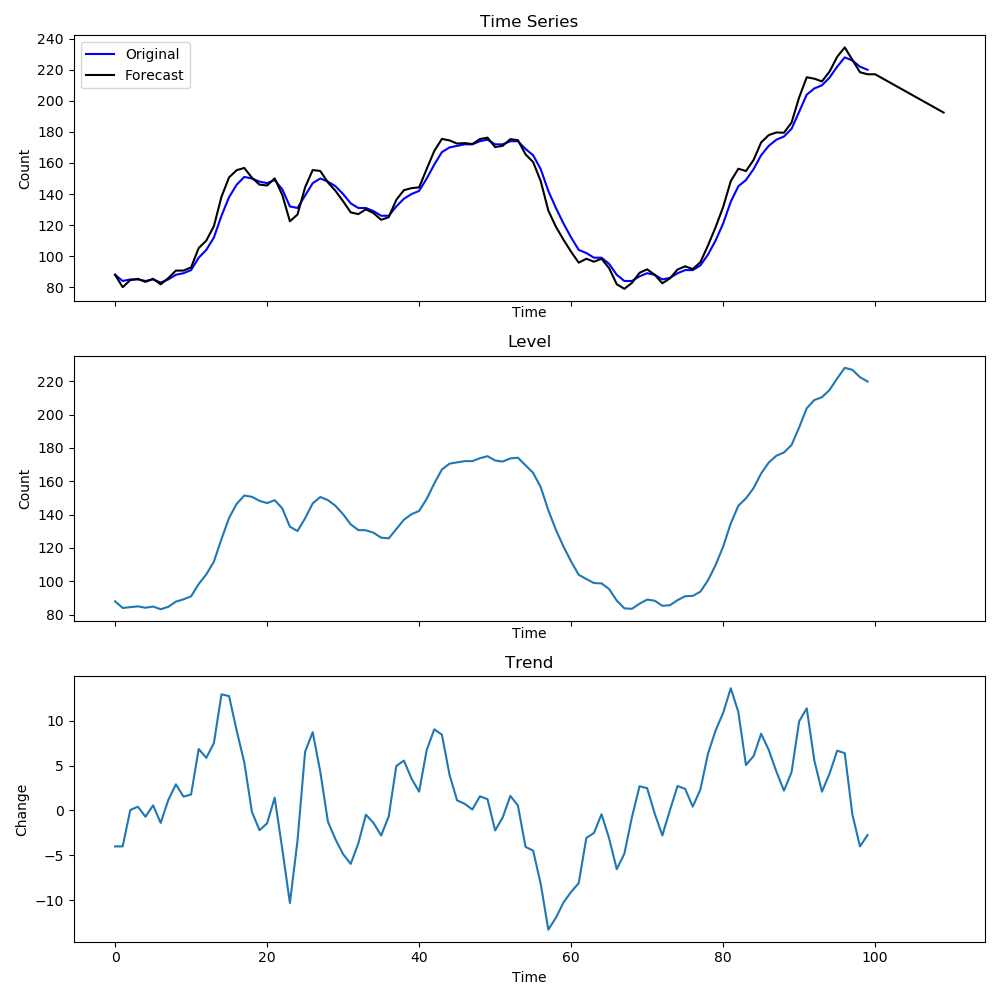

Both $\alpha, \beta \in [0,1]$. With the introduction of trend in the model, the forecast is no longer flat but linear in $h$. Figure below shows an example of how the levels and trends look for this method. The level is simliar to the series but the trend shows how much the values change at each time step.

Damped Trend Method

This method extends the above method to introduce variation in the trend. Since we do not expect the trend to remain the same, introducing some non-linearity can help reduce forecast errors. We introduce a dampening parameter $0 < \phi < 1$ into the previous method \begin{align} x_{t+h|t} &= l_{t} + (\phi + \phi^{2} + \cdots + \phi^{h})b_{t}\newline l_{t} &= \alpha x_{t} + (1-\alpha)x_{t|t-1}\newline &= \alpha x_{t} + (1-\alpha)(l_{t-1} + \phi b_{t-1})\newline b_{t} &= \beta(l_{t} - l_{t-1}) + (1-\beta)\phi b_{t-1} \end{align}

Notice that as $\phi \to \infty$, $x_{t+h|t} \to l_{t} + \phi b_{t}/(1-\phi)$ which means that for short term forecasts, the dampening will introduce variation, but long term forecasts will be near constant. In practice, $\phi \in [0.8, 0.98]$ as dampening has a strong effect on short term values, and $\phi$ close to 1 will reduce to a non-damped model.